Letter #25 – ✍️ Writing in Saigon 🇻🇳

In this letter, we’ll share:

Little things add up—just like compound interest. 🤑

Step-by-step guide to help you capture 100% of your bonus payout. 💰✨

This week’s been a blur of prepping for and celebrating Lunar New Year (Tết) 🧧🥳🎊—family and friend gatherings, blurry minds, and full hearts.

What really warmed Angie’s heart this year? Getting to know her neighbors better. She grew up in the neighborhood but was either too young or living abroad to connect.

Now, little chats with the neighbors on her way in/out of home give her doses of joy.

As for Tyler, this was his second Tết.

Last year, nobody could understand his Vietnamese. This year? He called out numbers perfectly in Viet bingo game, to everyone’s delight. 😲 Turns out, a year of twice-a-week Viet lessons with Angie’s mom paid off!

Whether it’s meaningful neighbor chats or language lessons, small efforts add up over time—just like compound interest. 🤑

We keep a third of our portfolio in S&P 500 index funds with a 10% annual return. We’re happy to trade higher-risk gains for something 100% passive, giving us the mental freedom to focus on what truly matters.

But the worst investment? 👎 No investment.

So set aside at least 5% of your paycheck and let compound interest do its magic. 🌱

Here’s our annual order of investments. Start small. It’ll snowball. Trust us. ✨

Celebrating Lunar New Year with our extended families 🧧 After 2 years being bombarded with family events, Tyler turned to Angie and said, “Everyone in your family is so warm. It’s a blessing to get along so well with your in-laws.”

It’s that magical time of year when our paychecks get fatter 💰 thanks to the annual bonus.

But before you start planning that luxury vacation, remember—Uncle Sam’s got plans for your bonus too. 🫵 Employers withhold a flat 22% on bonuses under $1M and 37% if you’re balling with more than that.

Let’s say you get a $10,000 bonus, $2,200 heads straight to the IRS, never see the light of day.

So how do you keep as much of it as possible?

Angie reaches out to HR to confirm when she can update her 401(k) contributions so it applies to her bonus paycheck, not just her regular salary.

Timing is key—too early or too late, and you’ll only save on normal income tax (which doesn’t hit the sweet 22%).

Well unless your salary is high enough to be in that tax bracket then good for you! 👏 But even then, maxing out pre-tax contributions can still supercharge your tax-advantaged game plan, especially if you’re using the Mega Backdoor Roth.

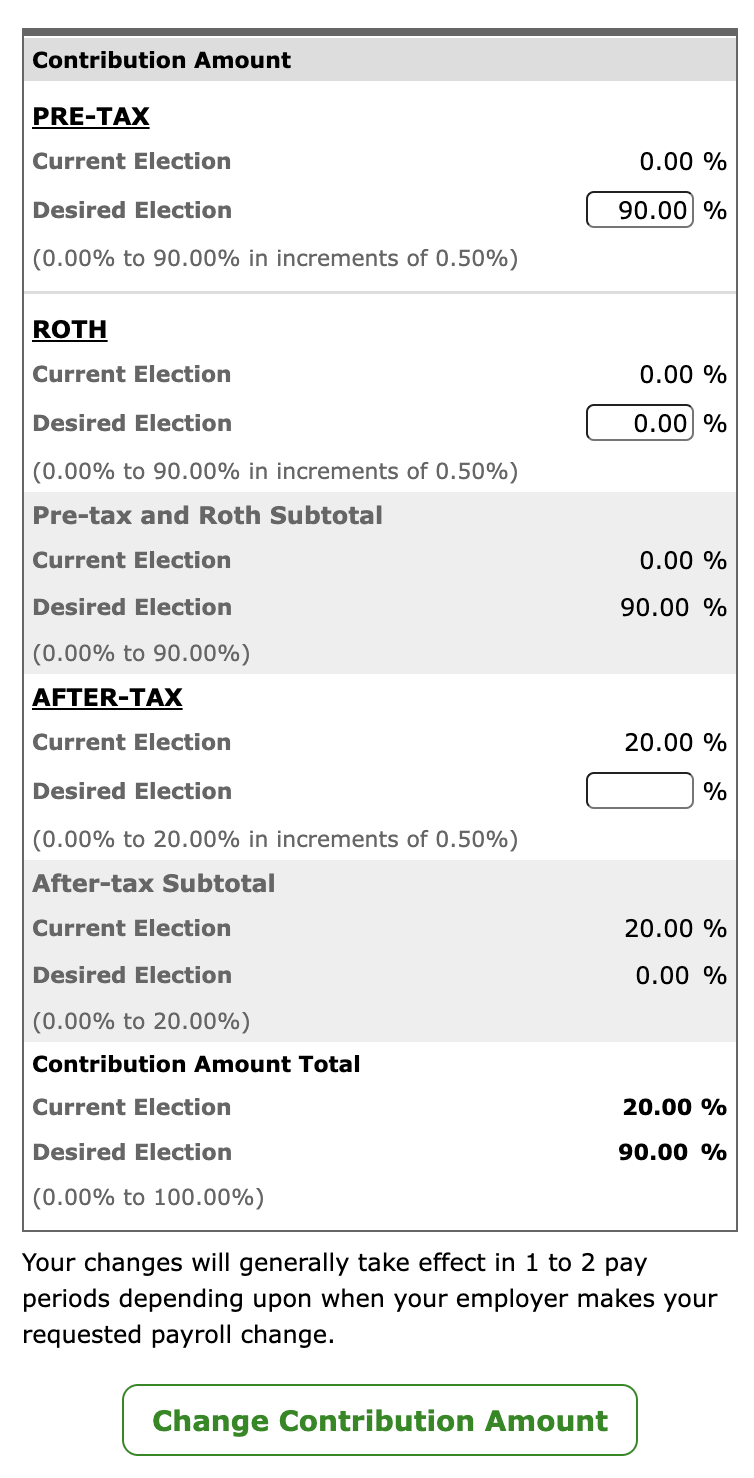

Once the window opens, she logs into Fidelity (her 401(k) provider) and temporarily cranks her pre-tax contribution to 90% of her bonus.

If your provider separates contributions for bonus vs. pre-tax, even better—you can max out the bonus-specific contribution first and shifts any leftovers to pre-tax.

What Angie sees under Contributions on her Fidelity account. Yours may be slightly different.

As soon as her bonus hits the bank, Angie hops back into Fidelity and lowers her contributions to a tolerable level.

If her 401(k) gets maxed out early, she seamlessly switches to the Mega Backdoor Roth.

Pre-tax power: Contributions reduce taxable income, meaning less of her total annual income gets swallowed by taxes. Plus, she’s saving on the upfront taxes she’d otherwise owe on the bonus. 💸

Future-proofing: Later, she converts it to a Roth IRA, letting her enjoy tax-free growth on those gains (but that’s a trick for another day). ✨

401(k) Limit (2025): $23,000 if you’re under 50, $30,000 if you’re 50+ (including catch-up contributions).

Contribute What Feels Right: Don’t feel pressured to max out if you need that bonus for important, time-sensitive expenses. Balance your savings goals with your current needs. 😘

Angie’s got her strategy, but you’ve got options too.

HSA Triple Tax Perks: Funnel bonus cash into an HSA—tax-free going in, growing, and coming out for medical expenses.

Defer the Bonus: Ask if you can push the payout to next year, especially if you expect a lower tax bracket (job change, retirement, etc.).

Employer Stock Plans: Allocate part of your bonus to stock options, RSUs, or an ESPP. Potential tax deferral + long-term gains = win.

Hope it's helpful for your journey to Freedom 🙏

Love you to freedom and back, 🫰

Angie & Tyler

🩹 Bandage: Here’s to hoping we never need bandages, 🤞 but if we do, at least we’ve got these cute lifesavers. We got them as a Christmas gift a few years ago and haven’t touched the Costco ones since. 🙃 They stick like a dream, don’t irritate skin, and seriously—how adorable are these designs? 🥹

🦷 Dental floss: We mentioned this in our first letter, but at this point, we can confidently say we’ll never go back to another type of floss. Angie used to hate flossing, but now she actually looks forward to it. Best of all—no PFAS (those harmful forever chemicals)!

accelerate your path to Financial Freedom 🚀

and level up Airbnb hosting experience. 💪

Personal Finance 💵

Airbnb & VRBO hosting 🏘️

Travel 🧳✈️

Free • 5-min read

Our hard-earned lessons on financial freedom, Airbnb hosting, and living your best life. 🐶⚾️

The tea is ready to spill. 💦

Let’s stroll to Freedom together!

No fluff. Good vibes and honesty Only 🙏🏼